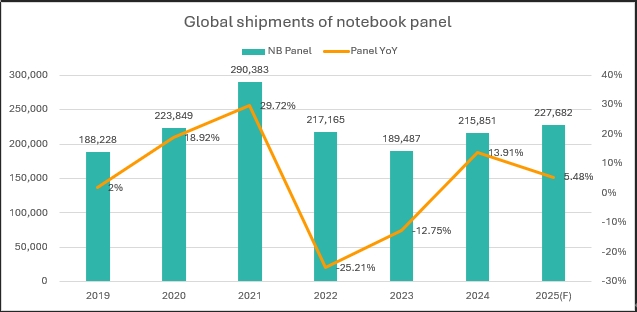

In recent years, amid global economic volatility and heightened geopolitical tensions, worldwide notebook PC panel shipments have remained broadly stable. Total shipments are projected to reach 227.7 million units in 2025, representing year-on-year growth of 5.48%. Driven by the rapid adoption of AI-enabled devices, high-end notebook panels are expected to emerge as the primary engine of future growth.

Over the past three years, the global penetration rate of high-end notebook panels has increased steadily, rising from 6.1% to 6.4% and then to 8.6%, reflecting a clear upward trend.

Within this segment, OLED notebook panels, as a key representative of premium display technology, recorded global penetration rates of 2.5%, 2.2%, and 4.5% over the past three years, and are projected to reach approximately 5% by 2027.

Dynamic privacy (anti-peeping) panels, another important high-end category, achieved global penetration rates of 1.3%, 1.6%, and 1.4% over the same period, with penetration expected to exceed 3% by 2027.

Meanwhile, Mini LED notebook panels have seen stable adoption growth, with penetration rates of 2.3%, 2.6%, and 2.7% over the past three years, and are also projected to surpass 3% penetration by 2027.

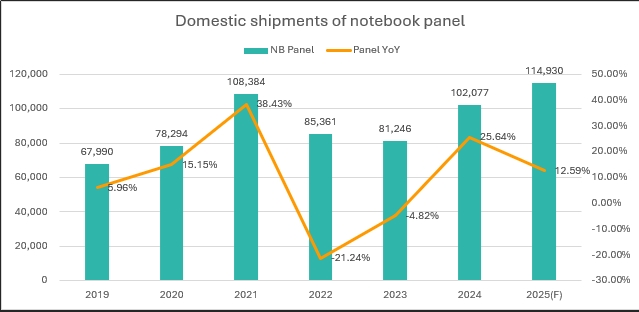

China Notebook PC Panel Market: Rising Global Share with Stable High-End Adoption

In recent years, China’s notebook PC panel shipments have increased steadily, with China’s share of global notebook panel shipments rising from 39.31% in 2022 to 42.88% in 2023 and further to 47.29% in 2024, highlighting China’s growing importance in the global supply chain.

Over the past three years, the penetration rate of high-end notebook panels in the China market recorded 5.6%, 4.8%, and 5.5%, respectively, indicating a broadly stable adoption trend.

Within the premium segment, OLED- and Mini LED-based notebook panels achieved China market penetration rates of 4.7%, 3.7%, and 4.9% over the same period, reflecting gradual recovery following short-term fluctuations.

Meanwhile, dynamic privacy (anti-peeping) notebook panels posted relatively limited adoption in China, with penetration rates of 0.9%, 1.1%, and 0.6% over the past three years.

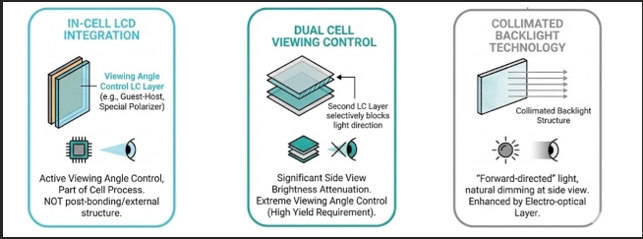

Technical Principles of Dynamic Privacy Displays: From “Add-On Privacy Films” to Deep Panel Integration

Early implementations of electronic privacy displays were conceptually close to adding an external privacy film in front of the screen. However, as brands increasingly demanded higher brightness, better uniformity, lower power consumption, and uncompromised image quality, modern privacy displays have evolved toward deep panel-level integration. Current technical approaches primarily include the following:

Integrated Viewing Angle Control Liquid Crystal Layers within the LCD Cell

This approach embeds a dedicated Viewing Angle Control (VAC) LC layer directly inside the LCD structure. Common implementations include guest–host liquid crystal systems and specialized polarizer combinations. When privacy mode is activated, the viewing angle is actively narrowed. This solution is part of the cell manufacturing process, rather than an externally attached or post-laminated structure.

Dual-Cell (Dual LC Layer) Viewing Angle Control

Dual-cell architectures introduce a second liquid crystal layer to selectively modulate light propagation, significantly reducing off-axis brightness. While this method enables more aggressive viewing angle restriction, it places stringent requirements on manufacturing yield and process control.

Collimated Backlight Optical Control

This solution relies on specially designed backlight modules that collimate light to favor forward emission, naturally reducing side-view luminance. When combined with electrically controlled layers, the privacy effect can be further enhanced. Early implementations from certain OEMs—such as the initial generations of HP Sure View—were conceptually aligned with this approach.

Compared with simple film-based privacy solutions, deeply integrated dynamic privacy panels offer several key advantages: they preserve image quality, brightness, and viewing angles in normal mode; enable one-touch, user-controlled privacy activation; and effectively balance the dual requirements of information protection and content sharing. As a result, these technologies have been widely adopted in high-end commercial notebook platforms from leading OEMs such as HP, Dell, and Lenovo.

Adoption of Dynamic Privacy Displays: An Established Value Proposition in Commercial Notebooks

Dynamic privacy display solutions are primarily adopted by users in high-security vertical markets. As a result, the widespread commercialization of this technology has been driven not by consumer brands, but by global OEMs with a long-standing focus on the commercial notebook segment.

HP — The Most Aggressive Global Promoter of Dynamic Privacy Displays

HP is widely recognized as the most active advocate of dynamic privacy display adoption. Sure View has become a strong and well-established market identifier with exceptionally high user awareness.

Early generations of Sure View were developed in collaboration with 3M, relying primarily on optical films and backlight modulation. In recent years, HP has gradually transitioned toward deeply integrated solutions developed jointly with panel makers.

HP is also one of the largest customers of IVO, playing a critical role in scaling up production and accelerating the industrialization of privacy panels.

Lenovo — Privacy Guard with AI-Aware Experience Optimization

Lenovo’s Privacy Guard solution, deployed across platforms such as the ThinkPad X1 Carbon and T series, emphasizes a balanced trade-off between privacy protection and front-view image quality. AI-assisted detection and user experience optimization are key differentiators in Lenovo’s implementation.

Dell — SafeScreen Targeting Government and Healthcare Markets

Dell’s SafeScreen (also referred to in some configurations as EPY displays) primarily targets North American government and healthcare sectors. Its dynamic privacy panels emphasize overall system balance, with relatively limited brightness degradation, making them particularly attractive for government procurement programs.

From a global brand-configuration perspective, privacy displays remain a high-ASP, professional-use segment, characterized by elevated specification thresholds and strict qualification requirements.

Primary Procurement Segments for Dynamic Privacy Displays Include:

– Financial services and insurance (front-desk operations, credit approval, back-office transactions)

– Government and defense (classified information protection)

– Healthcare institutions (patient data confidentiality)

– Law firms and large consulting organizations

– Multinational corporate executives and frequent business travelers

These markets share several defining characteristics:

– Extremely high privacy requirements

– Strong preference for long-term, stable suppliers

– Procurement driven by large-scale annual tenders

– Extended technology validation cycles, typically spanning two to three years

As a result, the dynamic privacy panel market differs fundamentally from mainstream consumer LCD markets, where supplier turnover is frequent. In contrast, privacy display adoption is governed by long qualification cycles, entrenched vendor relationships, and high switching costs.

Competitive Landscape of Dynamic Privacy Display Panels: A China-Led Supply Base with Complementary Taiwanese and Overseas Suppliers

The supplier landscape for dynamic privacy notebook display panels has gradually evolved into a structure led by China-based panel makers, supplemented by Taiwanese and other overseas suppliers.

Supplier Distribution by Region

China-based suppliers: IVO, BOE

Taiwan-based suppliers: AUO, Innolux

Japan-based suppliers: Sharp

Korea-based suppliers: LG Display

Among these suppliers, LG Display recorded only limited shipments in 2019 and did not achieve true volume-scale production in dynamic privacy notebook panels. In addition, Japan Display Inc. (JDI) has explored privacy-display technologies, though its applications have been primarily focused on automotive displays rather than notebooks.

Dynamic privacy displays represent a relatively small but extremely high-barrier professional segment. The technology places stringent requirements on optical architecture design, co-optimization between backlight systems and panel structures, and precise waveform and driving-voltage matching. As a result, only a limited number of panel makers are capable of delivering stable, scalable mass production.

Within this industry context:

- IVO has established a highly defensible leadership position, supported by mature technology, stable manufacturing yields, deep OEM collaboration, and meaningful cost advantages derived from scale.

- Although AUO began expanding its shipments in 2024, the structural characteristics of the dynamic privacy display market suggest that competitive shifts will be incremental rather than disruptive, with supplier replacement occurring gradually.

- As Taiwanese suppliers continue to increase shipment volumes, the competitive landscape is expected to further solidify into a China-led supply structure, complemented by Taiwanese and selected overseas panel makers.

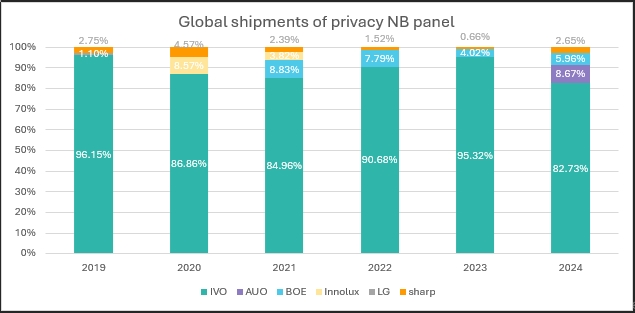

Global Dynamic Privacy Notebook Panel Market: Shipment Scale and Supplier Concentration (2019–2024)

In 2024, global shipments of dynamic privacy notebook display panels reached 3.02 million units, indicating that the segment has achieved a meaningful commercial scale, despite remaining a niche within the broader notebook display market.

Reviewing the period from 2019 to 2024, the global dynamic privacy notebook panel market has been highly concentrated, with IVO accounting for the vast majority of shipments. LG Display recorded only limited shipments in 2019 and did not establish sustained volume production. AUO began shipping dynamic privacy notebook panels in 2024, while Innolux suspended shipments of dynamic privacy notebook panels starting in 2022.

- In 2022, global shipments of dynamic privacy notebook panels were supplied by IVO, BOE, and Sharp, with shipment shares of 90.68%, 7.79%, and 1.52%, respectively.

- In 2023, the supplier base remained unchanged, though market concentration further increased. IVO expanded its share to 95.32%, while BOE and Sharp accounted for 4.02% and 0.66%, respectively.

- By 2024, the supplier landscape diversified modestly with the entry of AUO. That year, global shipments were distributed among IVO (82.73%), AUO (8.67%), BOE (5.96%), and Sharp (2.65%).

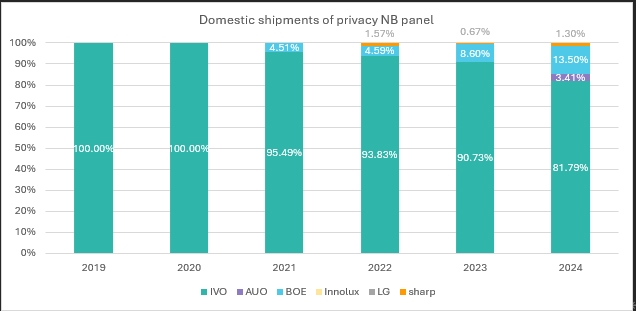

China Dynamic Privacy Notebook Panel Market: Supplier Evolution and Share Shifts

Prior to 2021, IVO was the sole supplier of dynamic privacy notebook panels in the China market. BOE began shipping to the domestic market in 2021, while Sharp maintained only limited shipments. AUO started ramping up shipments in 2024.

- In 2022, China’s dynamic privacy notebook panel shipments were supplied by IVO, BOE, and Sharp, with market shares of 93.83%, 4.59%, and 1.57%, respectively.

- In 2023, the supplier structure remained unchanged, though share distribution shifted modestly. IVO accounted for 90.73% of shipments, followed by BOE at 8.60%, and Sharp at 0.67%.

- By 2024, the China market saw further diversification with the entry of AUO. That year, shipments were distributed among IVO (81.79%), BOE (13.50%), AUO (3.41%), and Sharp (1.30%).